The problem frequency

Frequency in which your users experience the problem.

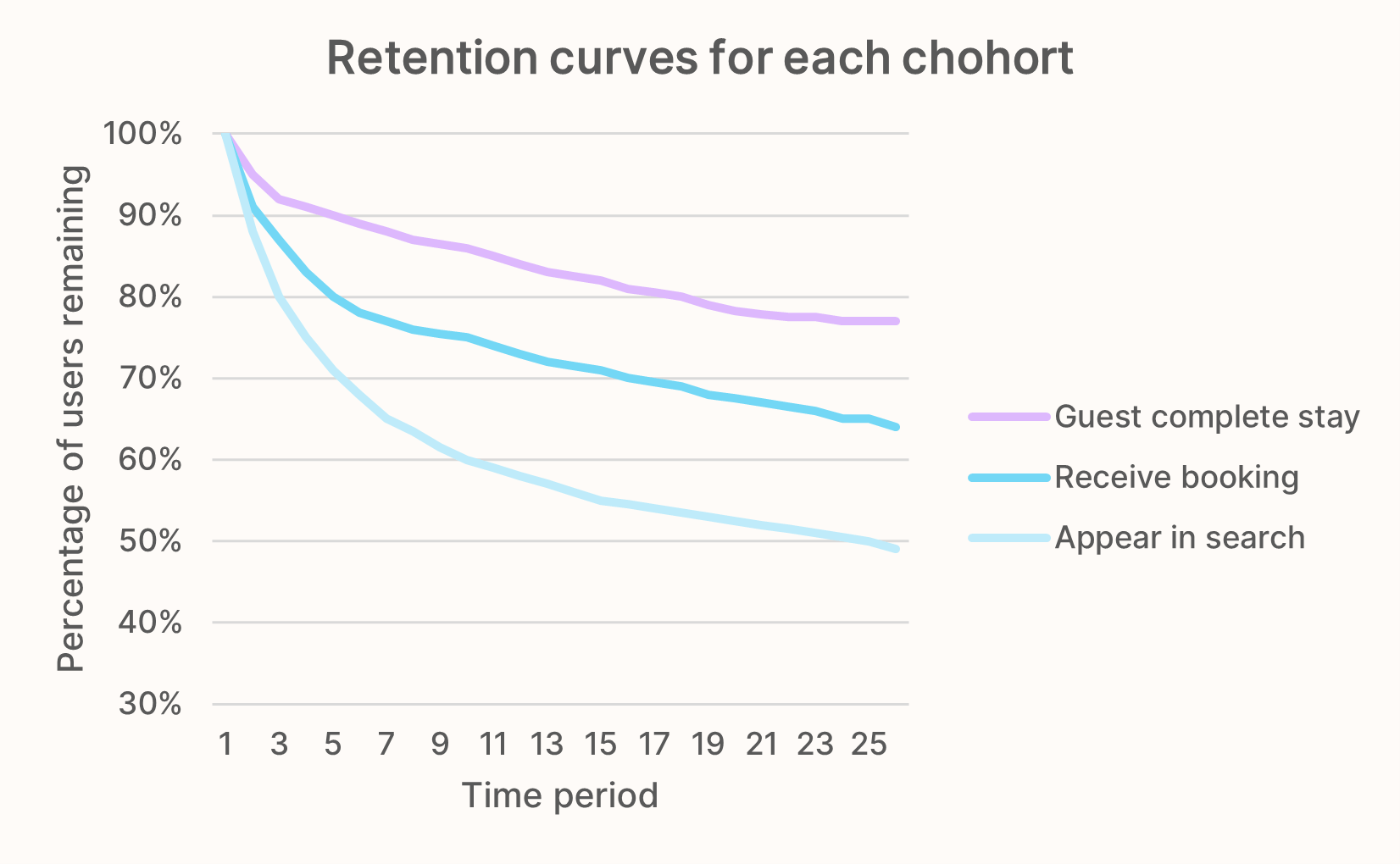

Measuring retention on the wrong cadence can trick you into thinking your product has good retention when it really doesn’t.

As a first step, we’ll try to understand the natural frequency in which your users are experiencing the problem. While we already covered this in the previous section where we built a use case map, it’s only a qualitative hypothesis so far. Now we need to validate it with data.

We are breaking it down further into three concrete tasks:

- Select one of your use cases.

- Create a frequency diagram.

- Analyze the frequency’s distribution.

This might sound intimidating, but it’s actually super easy.

Select a use case

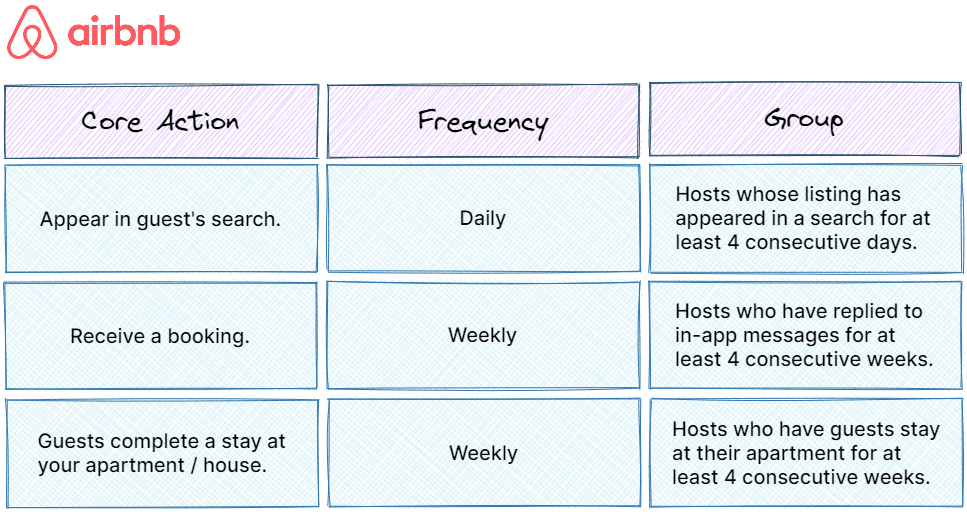

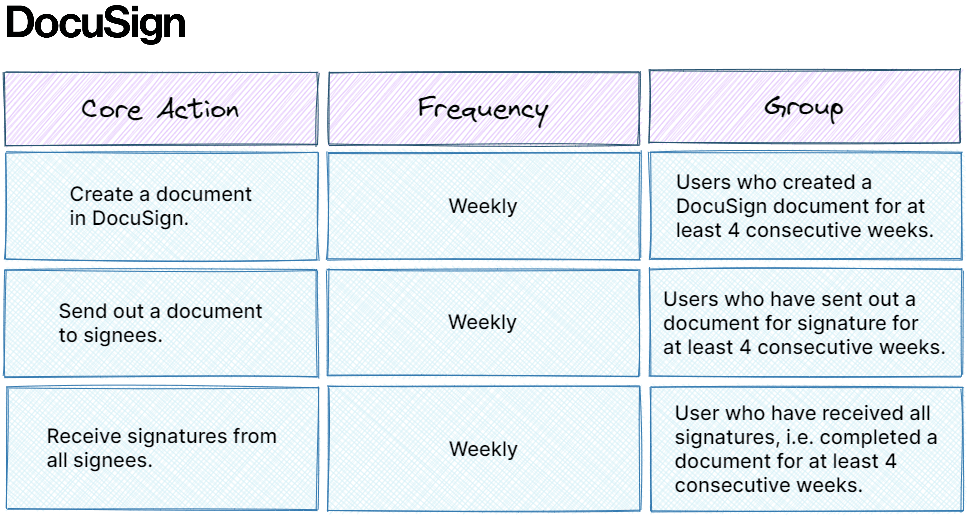

In the use case map section, we have seen that circumstances between different use cases of your product can vary quite a bit. That’s why we will define a retention metric for each use case individually.

For the “host” use case of Airbnb we hypothesized that the problem occurs weekly. Most hosts will want to rent out their property as many days per year as possible. It seems ok to assume the average guest will stay for 3-4 nights and there might be one or two requests from new guests coming in per week.

If we suspect a weekly frequency, we’ll need all active users who have been on the platform for more than four weeks. If you’re suspecting a daily frequency, it would be the same. In the case of monthly you’ll need all active users who signed up at least three or four months ago, otherwise you won’t be able to spot patterns.

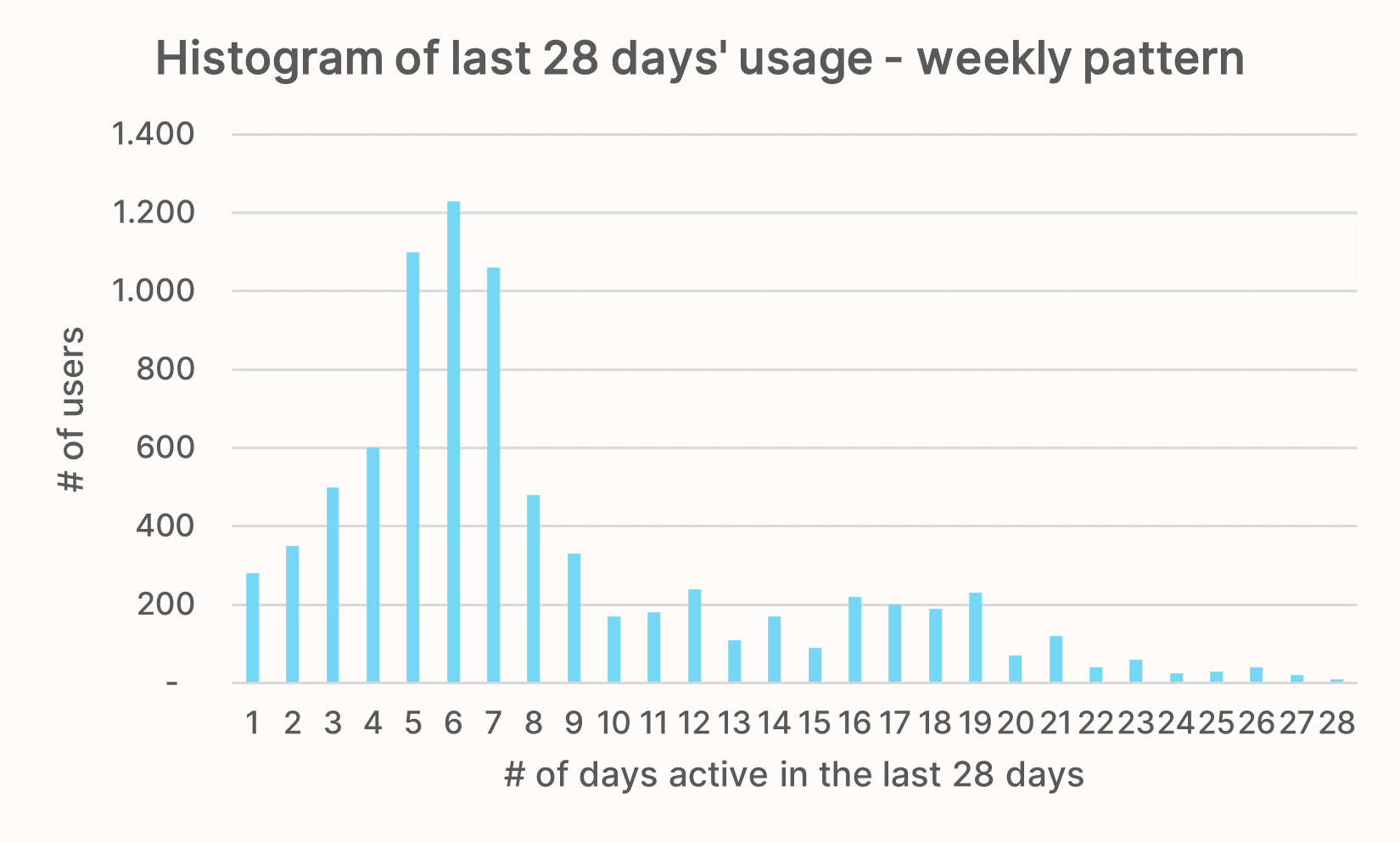

Create a frequency histogram

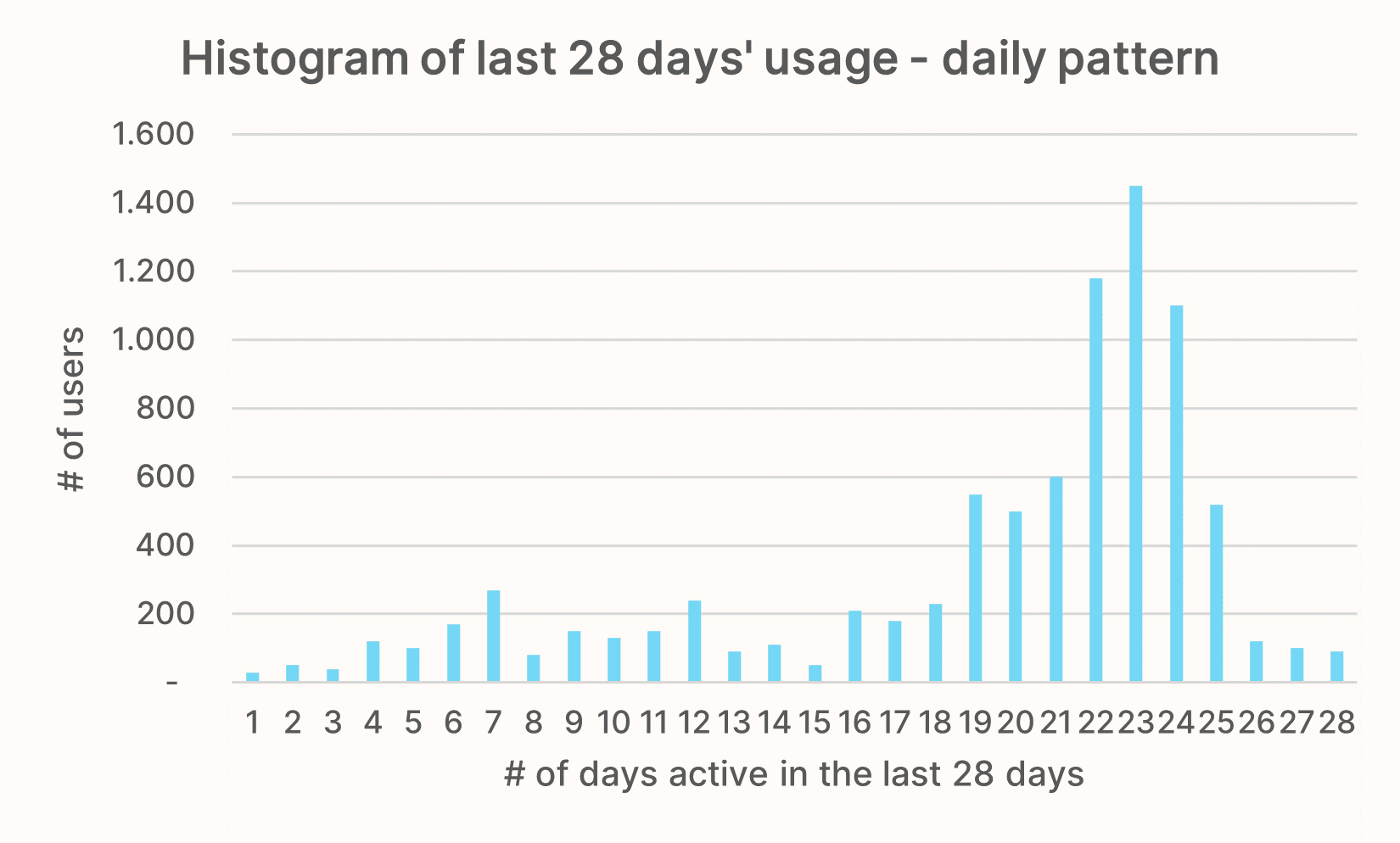

To create the frequency histogram, you’ll plot the number of users who have been active x number of days within the last 28 days. We will see soon what “active” means here.

- X-axis: How many days a user has been active in the respective day.

- Y-axis: The number of active users.

In this histogram we can see that 1,200 users have been active 6 out of the past 28 days.

Analyze the distribution

Ideally, there’s a clear pattern visible in the histogram. Let’s look at some exemplary charts to see how they’d be interpreted.

The following chart clearly belongs to a product with a daily natural frequency. Most of the users have been active 20 days or more within the last 28 days.

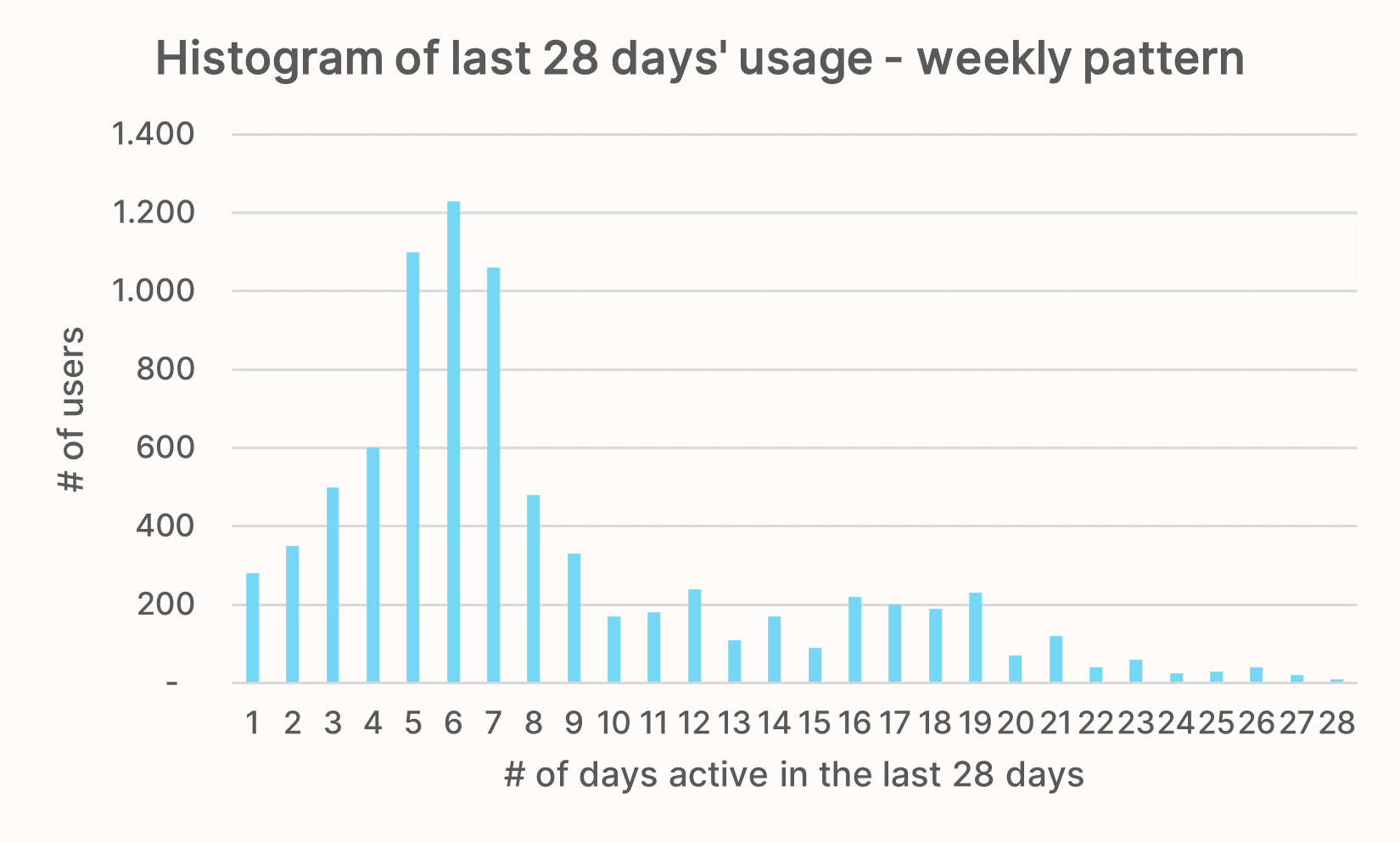

For a weekly frequency, there should be a clear peak of users active 5-8 out of the last 28 days. Given that a month (~28 days) has four weeks, this means that users are active roughly once per week.

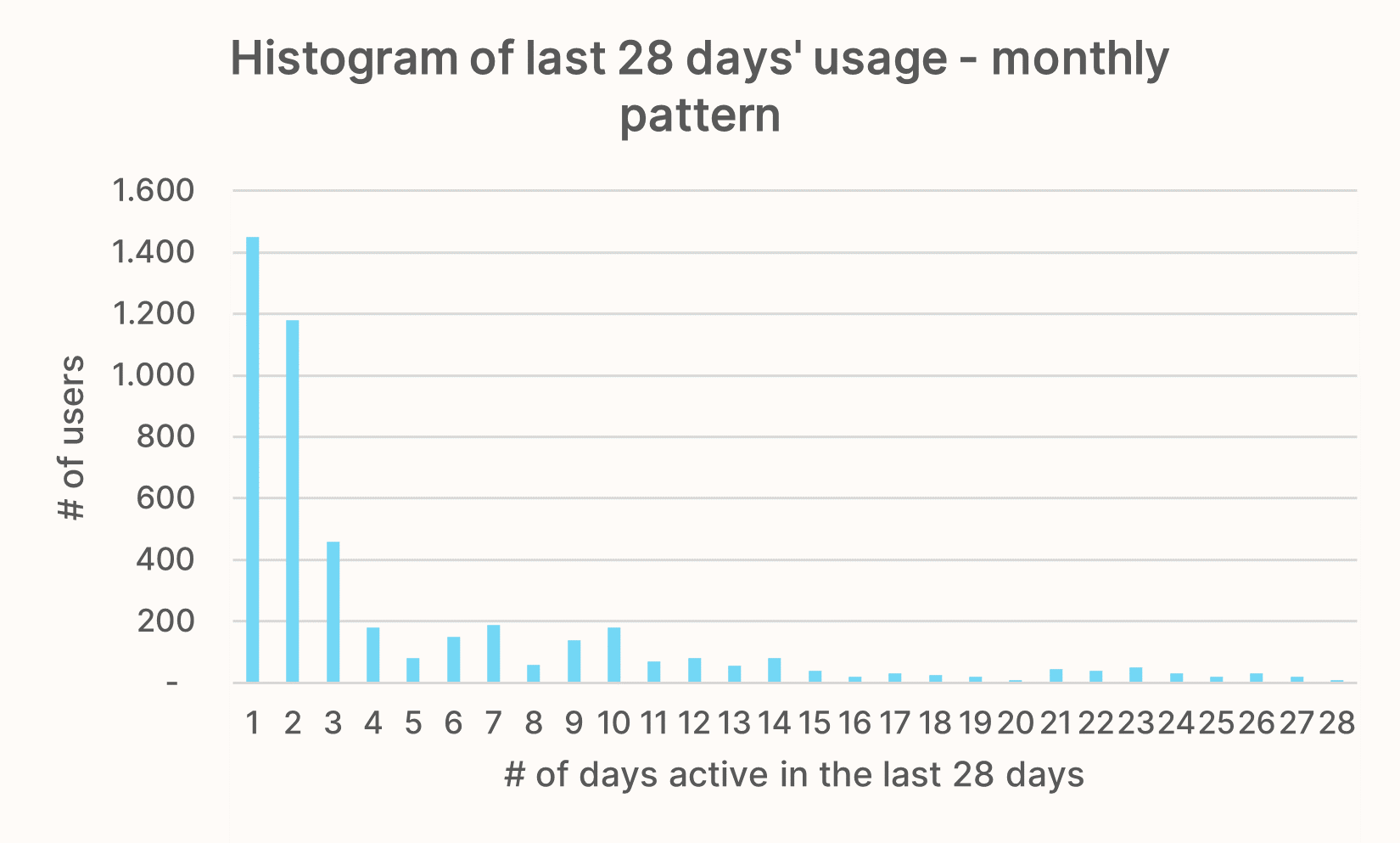

Finally, for a monthly frequency we would expect the histogram to congregate towards 1-3 days.

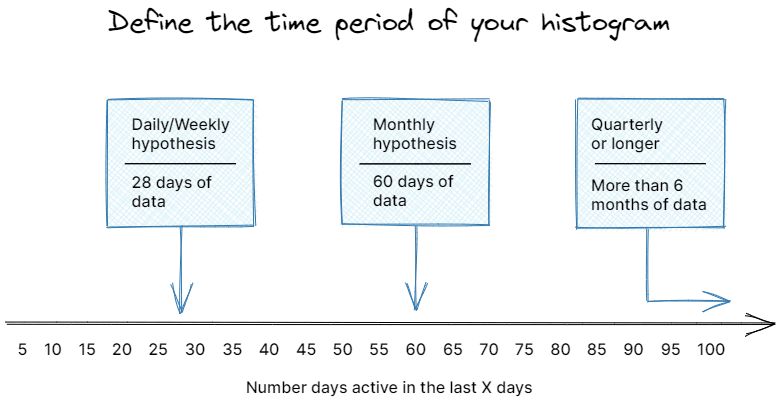

If your educated guess is that your product has a natural frequency greater than monthly, you can easily apply the same logic. Just extend the x-axis to cover a longer timeframe like three months (quarterly) or even twelve months (yearly).

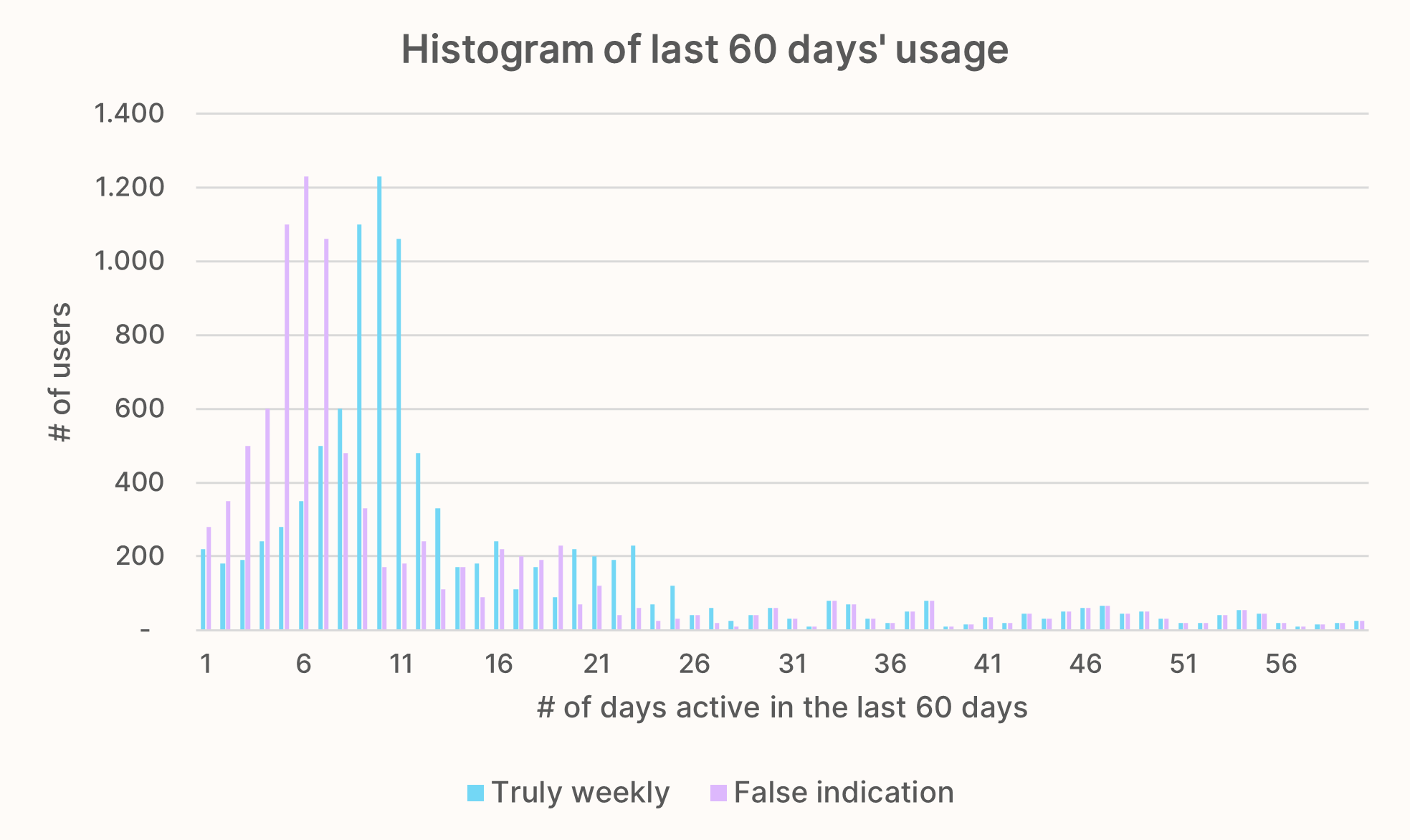

Pro tip: If you want to confirm that your histogram isn’t misleading, extend the timeframe and see what happens. If it indicates a daily frequency and you extend it from 28 to 60 days, does the peak area shift from ~23 to >50 days? For a weekly pattern, does it peak around 10 days if you extend the x-axis to the last 60 days?

The following chart shows the difference. In orange: How it looks like if the histogram stays the same even when looking at the last 60 days. This is a red flag that your frequency might not really be weekly. In blue: How it should look like to confirm a weekly frequency. The densest area has now shifted towards days 9 to 11.

When qualitative and quantitative analysis don’t match

You might be in the unfortunate situation that data doesn’t match your hypothesis at all. For example, you’re expecting a weekly frequency, but most users have only been active one day within the last month. This delta shows that your product is far away from what you want it to be. If you still base your retention metric on the weekly assumption, it’ll inevitably show bad retention.

You have two options:

- Go back one step and critically evaluate whether your qualitative assumption is realistic. Did you miss any important dimension during your initial, qualitative analysis? Did you talk to enough users? Have you maybe biased them towards a result that you wanted to get (weekly instead of monthly)? And of course: Is the data of your quant analysis correct?

- If you are super confident that both your quantitative and qualitative assessment is correct, then you’ll need to hunt down the reason why people are only using the product so seldom. Get a list of users who have only been active one or two days and talk to them. Ideally, you get hints what’s causing the frequency delta and can fix the root cause.